Social Security remains one of the most critical income sources for retirees, disabled individuals, and surviving family members across the United States. As inflation and healthcare costs continue to rise, beneficiaries increasingly look for legitimate ways to get extra money added to their Social Security check.

Many people mistakenly believe their Social Security benefit is fixed for life once claimed. In reality, benefit amounts can change based on earnings history, claiming strategies, supplemental programs, and annual adjustments.

Understanding how Social Security calculations work allows individuals to unlock additional income opportunities that are often overlooked. These opportunities can result in hundreds or even thousands of extra dollars over a lifetime.

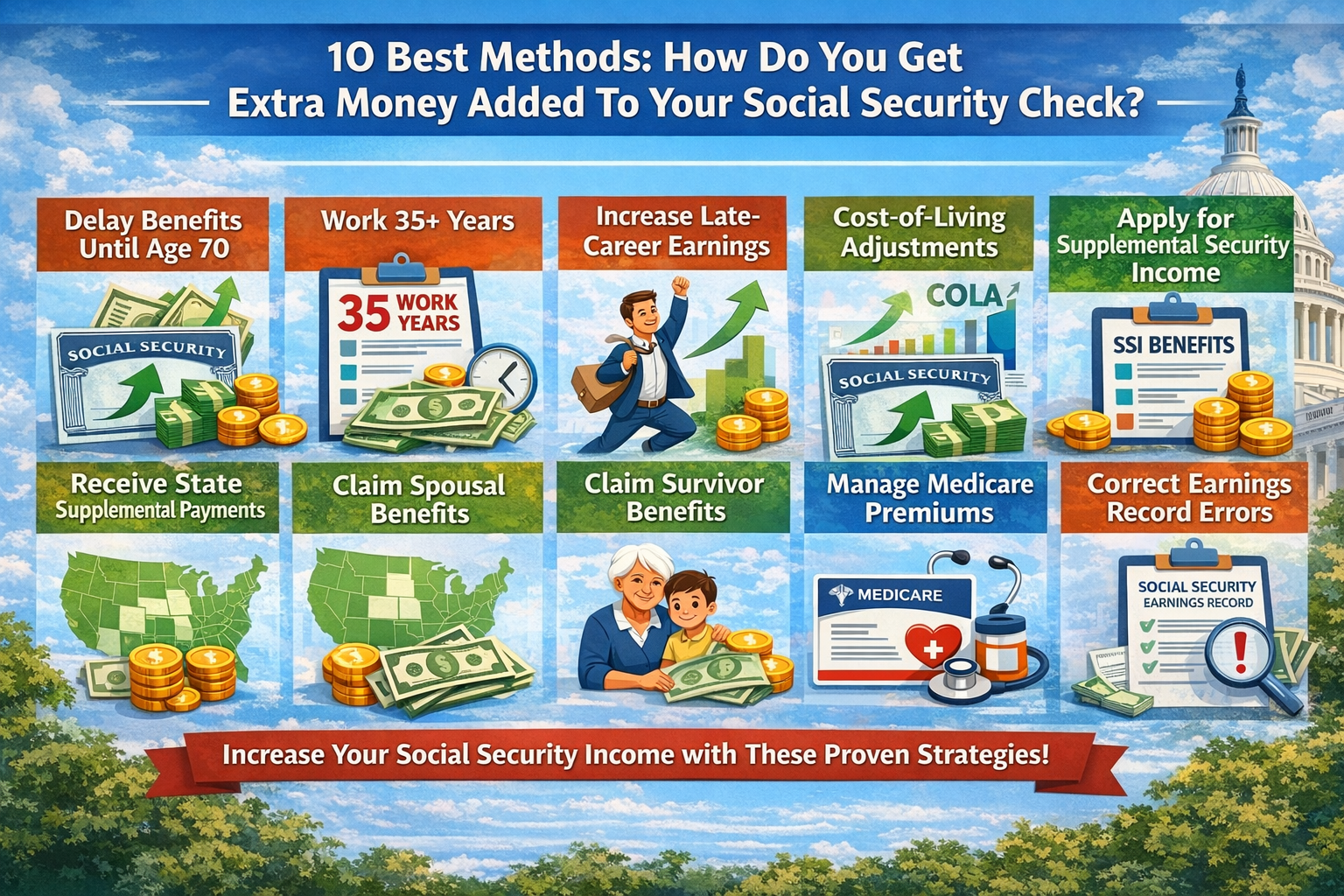

In this guide, you will learn the 10 best methods to increase your Social Security check, supported by statistics, official program rules, and structured strategies designed to improve long-term financial security.

How Do You Get Extra Money Added To Your Social Security Check?

1. Delaying Social Security Benefits – Social Security Administration (SSA)

Best for Maximum Lifetime Benefits

Delaying Social Security benefits beyond full retirement age allows beneficiaries to earn delayed retirement credits, increasing monthly payments permanently. According to the Social Security Administration, benefits increase by approximately 8% per year when delayed up to age 70.

This method is particularly effective for individuals in good health with alternative income sources. Higher monthly payments also result in larger future Cost-of-Living Adjustments, compounding the benefit over time.

Statistics show that retirees who delay benefits until age 70 receive up to 32% more per month compared to those who claim at full retirement age. This approach provides one of the strongest lifetime income protections available under Social Security.

Pros

-

Higher lifetime

-

Inflation protection

-

Guaranteed growth

-

No risk

-

Automatic increase

-

Survivor boost

-

Long-term security

Cons

-

Delayed access

-

Health risk

-

Requires savings

2. Working 35 or More Years – SSA Earnings Formula

Best for Replacing Zero Years

Social Security calculates benefits using the highest 35 years of indexed earnings, meaning fewer than 35 years results in zero-income years lowering the benefit. Continuing to work replaces low or zero years, increasing the monthly payment.

This strategy is ideal for individuals who took career breaks due to caregiving, education, or unemployment. Even moderate earnings can significantly improve the final benefit calculation.

SSA data indicates replacing just one zero-income year can increase monthly benefits by $25–$60, depending on earnings level. Over retirement, this translates into thousands of additional dollars.

Pros

-

Raises average

-

Easy to apply

-

Flexible work

-

Immediate impact

-

Lifetime increase

-

Low risk

-

SSA recognized

Cons

-

Requires work

-

Health limits

-

Time commitment

3. Increasing Late-Career Earnings – IRS & SSA Wage Reporting

Best for Boosting Benefit Base

Higher earnings during peak working years directly increase Social Security benefits because payroll taxes fund future payments. Income up to the Social Security taxable maximum counts toward benefit calculations.

Late-career earnings are especially powerful because they replace earlier lower-income years in the 35-year formula. Promotions, overtime, consulting, or self-employment income all contribute positively.

SSA statistics show workers who increase earnings in their final 10 years can raise benefits by 10–20%. This strategy pairs exceptionally well with delayed claiming.

Pros

-

Strong impact

-

Earnings control

-

Tax credited

-

Long-term gain

-

COLA growth

-

Flexible options

-

Career leverage

Cons

-

Tax exposure

-

Work stress

-

Income limits

4. Cost-of-Living Adjustments (COLA) – Bureau of Labor Statistics

Best for Inflation Protection

Cost-of-Living Adjustments automatically increase Social Security benefits based on inflation measured by the CPI-W index. In recent years, COLAs have ranged from 3% to over 8%, significantly impacting monthly income.

Although COLAs cannot be directly controlled, higher initial benefits result in larger dollar increases each year. Delayed claiming and higher earnings maximize COLA effectiveness.

According to SSA data, beneficiaries receiving higher base payments gain thousands more over retirement through compounded COLAs. This makes COLAs a powerful long-term income stabilizer.

Pros

-

Automatic increase

-

Inflation hedge

-

No application

-

Lifetime benefit

-

Predictable system

-

Compounding effect

-

Government backed

Cons

-

Inflation dependent

-

Variable amounts

-

No timing control

5. Supplemental Security Income (SSI) – Social Security Administration

Best for Low-Income Retirees

Supplemental Security Income provides additional monthly payments to individuals with limited income and resources. SSI operates separately from retirement benefits but can be received simultaneously if eligibility rules are met.

According to SSA statistics, over 7.4 million Americans receive SSI payments, many of whom also collect Social Security. SSI can add hundreds of dollars per month, depending on income and living arrangements.

Eligibility is based on strict income and asset limits, but many retirees mistakenly assume they do not qualify. Applying for SSI can significantly increase total monthly income for eligible individuals.

Pros

-

Monthly supplement

-

Needs-based help

-

Federal program

-

Automatic COLA

-

Reliable support

-

Healthcare access

-

Stable income

Cons

-

Asset limits

-

Strict eligibility

-

Application process